The economist who first linked the yield curve to recessions sees 'pretty high' chance of downturn

Traders work on the floor of the New York Stock Exchange.

Brendan McDermid | Reuters

Arturo Estrella, the economist who first discovered the predictive power of the yield curve, has a message for recession naysayers: It could hit sooner than you think.

"It's been 50 years and 7 recessions with a perfect record," Estrella told CNBC in a message Thursday. "It's impossible to be 100% sure about the future but I'd say the chances of a recession in the second half next year are pretty high."

Estrella was a professor of economics at Rensselaer Polytechnic Institute and was once an economist at the New York Federal Reserve. Working at the Fed, Estrella studied the spread between the 10-year Treasury note and the 3-month Treasury bill as a recession predictor and found that particular part of the curve was the most accurate. It dipped below zero this year and is still inverted.

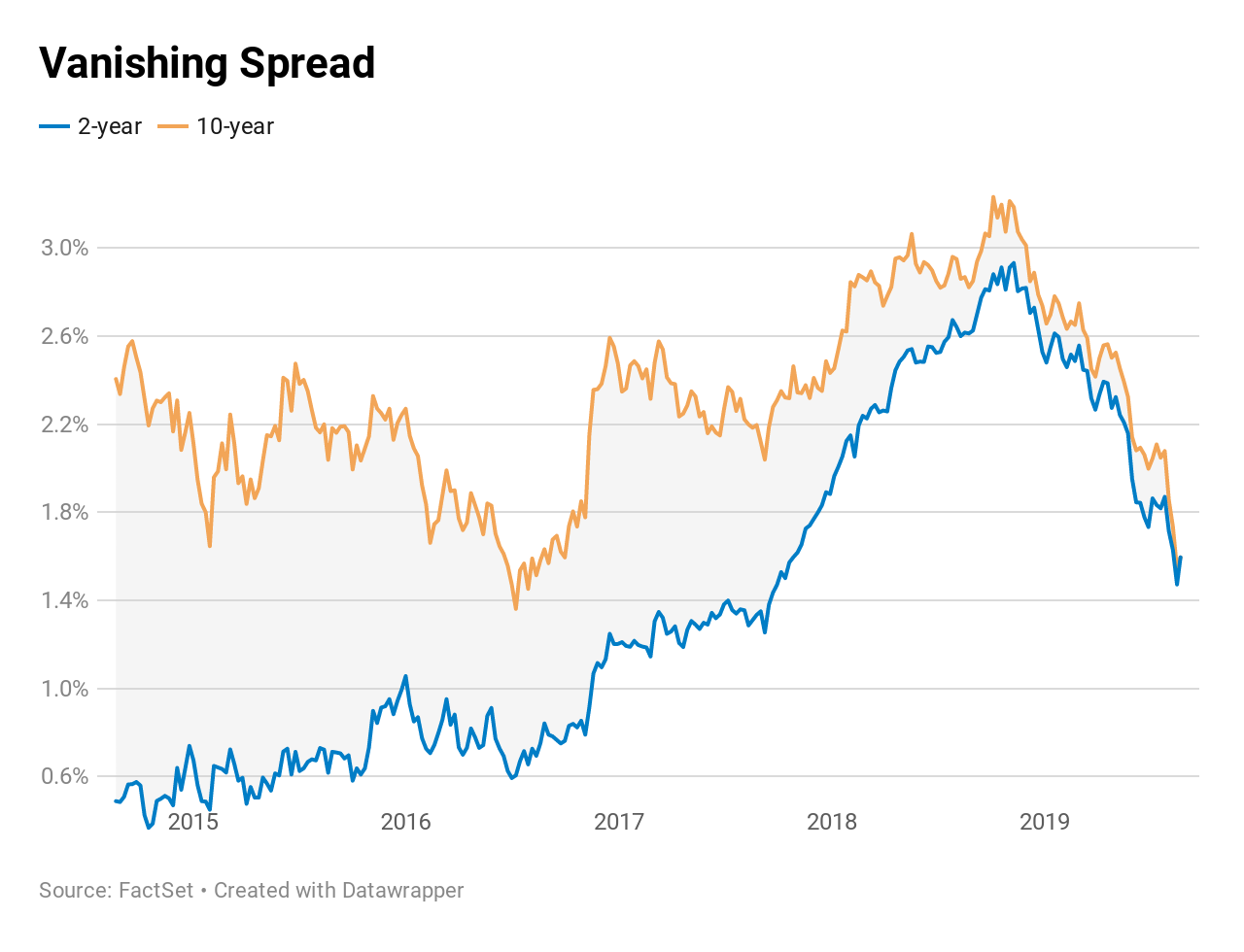

More parts of the so-called curve have started to invert, raising investors' recession fears. On Thursday, the spread between the yield on the 10-year Treasury note and that of the 2-year note turned negative for the third time in less than two weeks since Aug. 14. As of 4:05 p.m., it was still inverted with the 2-year yield at 1.61% and the 10-year rate at 1.606%. The previous two inversions were just brief moments.

This bond market phenomenon has been a reliable recession indicator preceding each downturn over the past 50 years. What has Estrella worried is that the part of the curve he really follows — the 3-month/10-year — has remained inverted for months with the spread widening. Currently the 3-month Treasury bill rate is 1.987%.

"Those who say things are different each time are probably counting on the fact that it will take about 2 years to know for sure, so who's going to remember?" Estrella added in the message.

Credit Suisse found that it took, on average, 22 months before a recession hit following a 2-year and 10-year inversion going back the last four decades.

Read More

No comments